Medicare Open Enrollment is upon us….October 15- December 7. This is the time of year that Medicare participants may change their Medicare Supplemental or Medicare Advantage Plan. Here is the 50,000 foot view of how Medicare and it’s various related parts work.

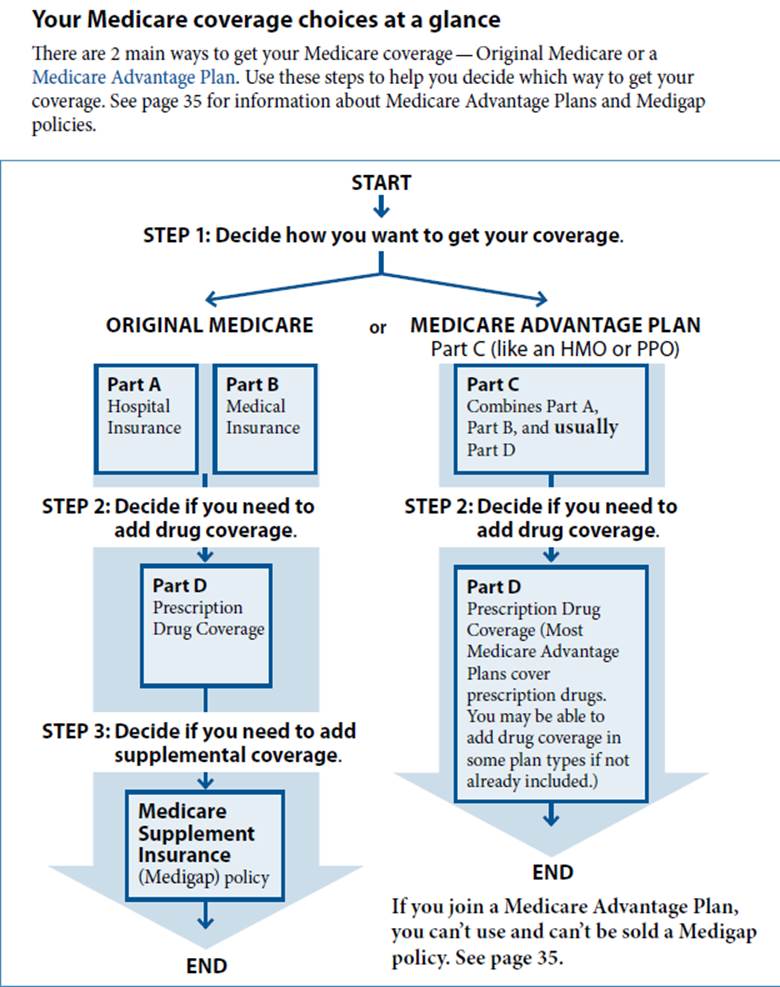

In a nutshell, the participant’s first decision is to decide whether to go the Medicare Original (a.k.a. Medicare Parts A & B) route or an Advantage Plan (a.k.a. Medicare Part C) route. If Medicare Original is chosen, the participant will need a supplemental Medicare policy and prescription drug policy (Medicare D). Medicare C or Advantage plans wrap all of these parts into a single package. Medicare Supplemental, Medicare C and Medicare D are policies which are offered by private insurance companies.

Medicare Advantage plans are generally HMOs or PPOs meaning that participants may be restricted to seeing only certain doctors and/or may need to obtain a referral from a GP to see a specialist. It’s important that participant understands this restriction. These plans may also offer additional benefits and services, such as dental coverage, for additional costs.

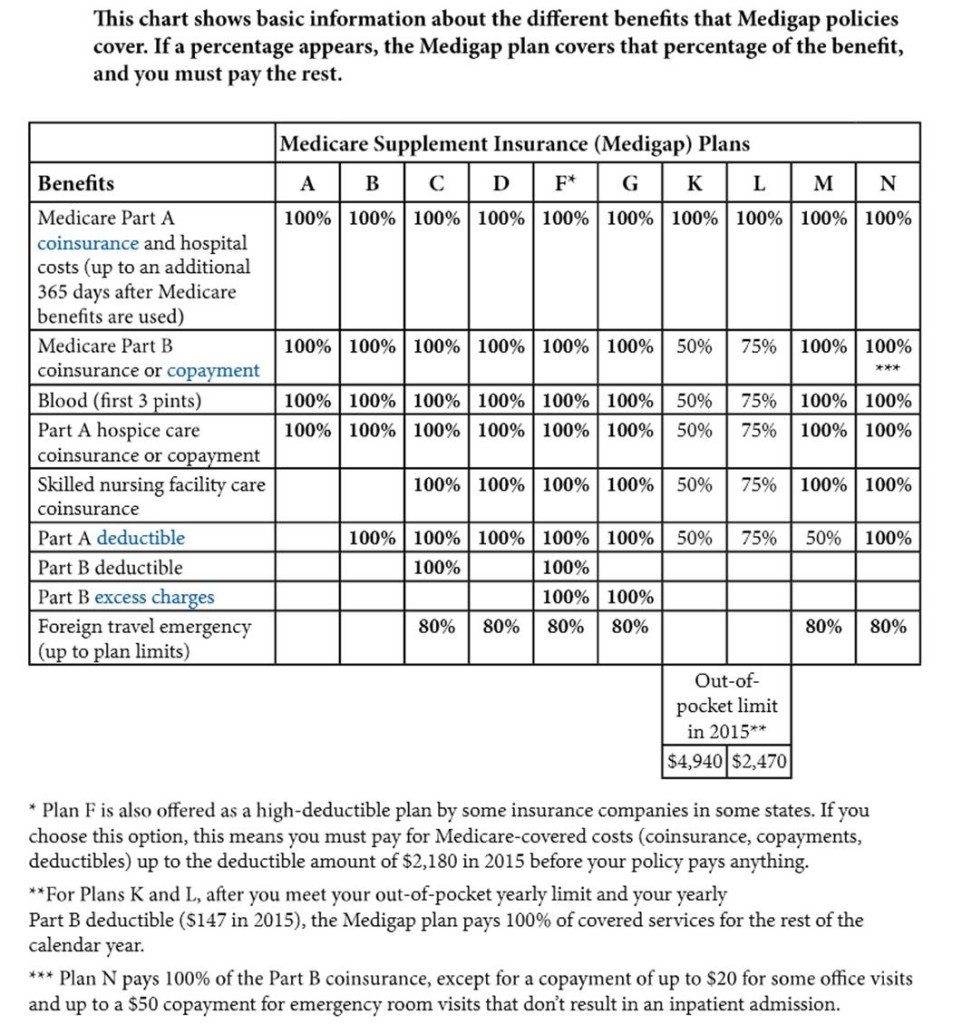

Medicare Supplement policies come in ten different standardized plans and each plan has different benefits. For example, benefits such as coverage while traveling to foreign countries may or may not be offered depending on the plan. Insurance companies who offer Plan A must offer the same, standard Plan A to all prospective insureds, and companies who offer Plan B must offer the same, standard Plan B, etc. However, insurance companies set their own premiums for each standard plan. So it is important to review premiums from several companies.

The best source of Medicare information is the government site at www.Medicare.gov. The site has a tool to help participants find plans, which is good news. The bad news – entering only general information in the Finder tool (zip code and current Supplement Plan F) returned 54 available plans in the central Ohio area. This is when clients need to be referred to a health insurance agent!

Keeping you informed are the trusted attorneys from Browning & Meyer Co., LPA. Please contact our law office with any questions about Medicare or other elder law concerns.